Exploring Africa’s Economic Shifts: Kenya cuts spending, Zimbabwe’s deficit, South Africa’s new diplomat, Tanzania Breweries’ sale, and Niger’s IMF funds.

Kenya is poised to implement significant adjustments to its 2024-25 fiscal plan, including a 1.9% reduction in spending and an expansion of the fiscal deficit to 3.6% of GDP. These measures follow a wave of public protests that prompted the government to withdraw previously proposed tax increases.

In a dramatic response to widespread unrest, which included demands for his resignation and comprehensive reforms, President William Ruto took the unprecedented step of dismissing nearly his entire cabinet. This bold move is part of his strategy to form a more inclusive government that can better address the concerns of the Kenyan populace and restore stability.

Adjustments to the Fiscal Plan

The retraction of the tax hikes, which were initially introduced to bolster government revenue, has resulted in a substantial budgetary shortfall of $2.7 billion. To address this financial gap, President Ruto has proposed a series of spending cuts and plans to increase borrowing. These fiscal measures aim to navigate the budgetary constraints imposed by the removal of the tax increases while striving to maintain essential services and support economic stability.

Next week, Kenyan legislators will engage in a critical debate over the supplementary budget, which reflects a revised total spending of 3.87 trillion Kenyan shillings (approximately $30 billion). This new figure represents a reduction from the originally planned 3.99 trillion shillings. The revised budget includes a reduction in recurrent expenditure by 2.1% and a dramatic cut in development expenditure by 16.4%. These adjustments signify a deliberate effort by the government to align its financial commitments with the new fiscal realities while attempting to minimize the impact on key development projects.

Changes to Tax Policies

In light of the withdrawal of the broader tax hikes, the government has made a notable adjustment by increasing the road maintenance levy. This levy on fuel has been raised from 18 to 25 shillings per liter. This increase aims to support vital infrastructure projects, particularly road maintenance, while addressing the fiscal shortfall caused by the retraction of the other tax measures.

International Pressure and IMF Scrutiny

President Ruto’s administration faces intense scrutiny from international financial institutions, notably the International Monetary Fund (IMF). The IMF has been a vocal advocate for reducing fiscal deficits and ensuring effective budget management. Given the current economic climate, including high living costs and ongoing public dissatisfaction, the IMF’s recommendations and oversight are crucial. The IMF is closely monitoring Kenya’s economic adjustments and will likely revise its support and recommendations based on the effectiveness of the new fiscal measures.

Implications of the Fiscal Adjustments

The planned reductions in spending and the expanded fiscal deficit represent a critical juncture in Kenya’s economic management. Balancing the need for fiscal responsibility with the pressures of public discontent and international financial expectations presents a complex challenge for President Ruto’s government. The outcome of the upcoming legislative debate will be pivotal in determining the effectiveness of the proposed budgetary measures and their impact on Kenya’s economic stability.

Conclusion

As Kenya moves forward with its revised fiscal plan, the focus will be on effectively managing the budgetary adjustments while addressing public and international concerns. The government’s approach to handling the fiscal shortfall through spending cuts and strategic borrowing will play a crucial role in shaping the nation’s economic trajectory. Ensuring that these measures are implemented effectively and equitably will be essential for maintaining stability and supporting sustainable economic growth. The upcoming decisions and legislative outcomes will be closely watched by both domestic and international observers, marking a critical phase in Kenya’s economic management and governance.

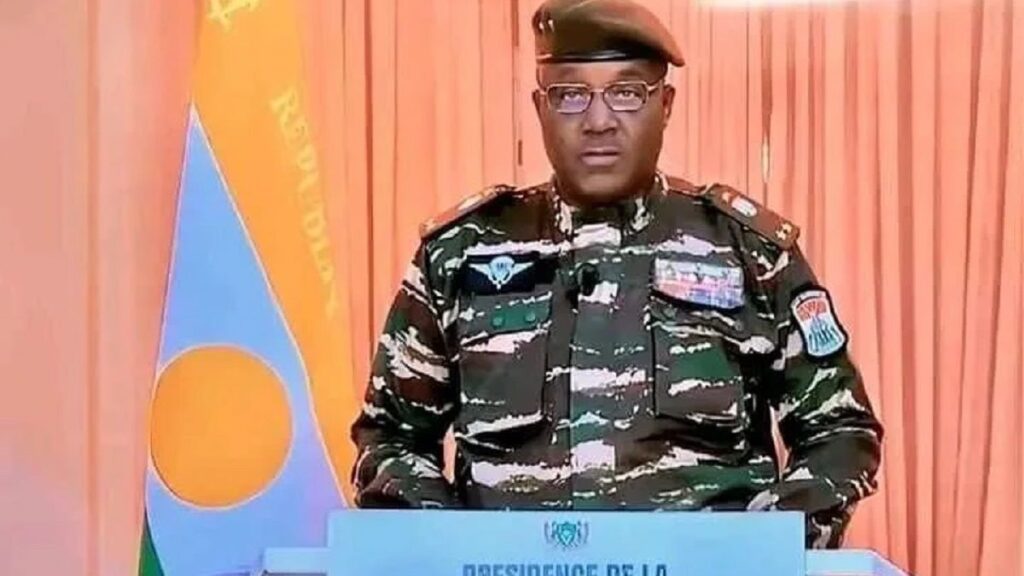

Niger receives IMF’s $71 million disbursement

Niger is on track to receive a new series of financial support from the International Monetary Fund (IMF), aimed at bolstering its economic stability and addressing long-standing balance of payments issues. This support comes as part of the IMF’s ongoing commitment to assisting Niger in its efforts to implement crucial reforms and navigate its financial challenges.

IMF Support and Loan Disbursements

On Wednesday, the IMF Executive Board completed the Fourth and Fifth Reviews of Niger’s economic and financial program, which is supported by the Extended Credit Facility (ECF) arrangement. Additionally, the Board concluded the First Review under the Resilience and Sustainability Facility (RSF) arrangement. These reviews mark significant milestones in Niger’s engagement with the IMF and its broader economic reform agenda.

The successful completion of these reviews has facilitated the immediate disbursement of approximately SDR 19.74 million (about USD 26 million) under the ECF arrangement. This latest release brings the total amount disbursed under the ECF to approximately SDR 157.92 million (around USD 210 million). Furthermore, Niger will receive SDR 34.216 million (about USD 45 million) under the RSF arrangement. These funds are pivotal for Niger as it works to stabilize its economy and implement necessary reforms.

Background of the IMF Arrangements

Niger’s ECF was initially approved on December 8, 2021, as a critical component of the country’s economic reform strategy. This arrangement was designed to support Niger in addressing its fiscal and monetary challenges while promoting structural reforms to enhance economic resilience. The RSF was introduced later, in July 2023, to complement the ECF and provide additional support for long-term sustainability and resilience.

To ensure that Niger has sufficient time to fully implement the required reforms and support its fiscal consolidation efforts, both the ECF and RSF arrangements have been extended by an additional six months, now running through December 2025. This extension reflects the IMF’s recognition of the need for ongoing support and flexibility in light of the country’s evolving economic and political situation.

Impact of Political Crisis

While the implementation of Niger’s economic programs was progressing well through late June 2023, the country has since been disrupted by a severe political crisis. This upheaval has led to significant setbacks, including the accumulation of both external and domestic debt service arrears. The political instability has complicated the economic landscape, presenting challenges to the continuity of reform efforts and the management of financial obligations.

Importance of IMF Support

The new financial assistance from the IMF and the extended arrangements are crucial for Niger as it seeks to overcome these challenges. The funds will be instrumental in addressing immediate balance of payments needs, covering arrears, and supporting the implementation of structural reforms. This support is also vital for restoring investor confidence and ensuring the stability of Niger’s economic framework.

The IMF’s engagement underscores the international community’s commitment to Niger’s economic stability and resilience. By providing this financial support, the IMF aims to help Niger navigate its current challenges, stabilize its economy, and lay the groundwork for sustainable development and growth.

Broader Implications

The IMF’s support for Niger is not only a testament to the country’s strategic importance in the broader regional context but also highlights the critical role of international financial institutions in supporting countries facing economic and political upheaval. The extended arrangements and new disbursements will play a significant role in Niger’s efforts to stabilize its financial situation, address debt arrears, and implement essential reforms.

As Niger moves forward, the continued support from the IMF and other international partners will be essential in ensuring that the country can achieve its economic goals, maintain fiscal stability, and foster long-term growth. The ongoing commitment to Niger’s economic reform agenda reflects a broader recognition of the need for sustained international cooperation and support in navigating complex economic challenges.

Tanzania Breweries sells dormant Darbrew unit

Tanzania Breweries Ltd (TBL) Plc has recently executed a series of strategic financial maneuvers aimed at restructuring its operations and addressing various challenges within its business units. These moves include the finalization of the sale of its 60 percent stake in Darbrew Ltd, an investment in upgrading its Kibo Breweries Ltd facility, and a major revitalization project for the Kilimanjaro Malting Plant. These steps are part of TBL’s broader turnaround strategy to enhance operational efficiency, improve financial stability, and foster sustainable growth.

Sale of Darbrew Ltd

TBL’s decision to divest its 60 percent stake in Darbrew Ltd, a beer manufacturing subsidiary, marks a significant shift in its strategic focus. Initially approved by TBL’s board on August 7, 2019, the sale faced numerous delays, primarily due to undisclosed complications that hindered its swift execution. However, as of the accounting period ending December 31, 2023, the transaction has been successfully concluded.

The sale was executed with Dar es Salaam City Council (DCC), a core shareholder, acquiring the stake. This divestment was driven by Darbrew Ltd’s persistent underperformance and its status as a dormant operation. By finalizing this sale, TBL aims to streamline its operations and refocus its resources on more promising ventures.

The decision to offload Darbrew Ltd underscores a strategic realignment by TBL, reflecting a broader trend of companies reassessing their portfolios to eliminate non-performing assets and concentrate on core operations that offer better growth prospects.

Upgrading Kibo Breweries Ltd

In a parallel move, TBL has embarked on a substantial upgrade of its Kibo Breweries Ltd facility. Despite an investment of Tsh42.41 billion (approximately USD 15.83 million), Kibo Breweries has remained inactive throughout the year. This investment is part of a strategic initiative to rejuvenate the facility and revitalize its production capabilities.

The upgrade is particularly focused on enhancing the facility’s malting plant, with expectations for it to become operational by 2024. The decision to invest in Kibo Breweries demonstrates TBL’s commitment to turning around its underutilized assets and improving its production infrastructure.

Management has also conducted an impairment assessment of its investment in Kibo Breweries, concluding that no impairment allowance is necessary at this time. This assessment reflects confidence in the facility’s future potential and a belief in the successful execution of the upgrade plans.

Kilimanjaro Malting Plant Revitalization

Another significant development is TBL’s announcement of an extensive investment in the Kilimanjaro Malting Plant, which has been non-operational since 2017. The plant’s closure was due to a combination of factors, including insufficient local barley supply, high water usage, excessive electricity costs, and outdated technology.

TBL’s plan to upgrade the Kilimanjaro Malting Plant aims to address these issues and restore the facility to full operational status. The project’s initial phase will focus on processing approximately 10,000 tonnes of barley, with plans to scale up to 28,000 tonnes. This revitalization is expected to have a substantial impact on Tanzania’s agricultural sector, particularly by supporting local barley farmers and contributing to the country’s agricultural economy.

The initial phase of the Kilimanjaro project is projected to be completed by the fourth quarter of 2024. TBL’s commitment to this project highlights its dedication to enhancing agricultural practices and supporting local farmers through improved business and financial practices.

Financial Performance and Strategic Outlook

TBL’s financial performance in 2023 reflects both the challenges and the strategic responses undertaken by the company. The cash generated from operations declined by nine percent, totaling Tsh335.86 billion (USD 125.42 million), down from Tsh368.82 billion (USD 137.73 million) in 2022. This decline underscores the impact of various operational and external challenges on the company’s financial stability.

Capital expenditure for the year amounted to Tsh87.53 billion (USD 32.68 million), an increase from Tsh82.35 billion (USD 30.75 million) invested in 2022. This increased capital investment highlights TBL’s focus on upgrading and expanding its production facilities to drive future growth.

TBL currently sources 74 percent of its raw materials domestically, reflecting a commitment to supporting the local economy. The company is majority-owned by Anheuser-Busch InBev (AB InBev), which holds a 63.95 percent stake. AB InBev, the world’s largest brewer, operates in over 50 markets globally and has a significant presence in 15 African countries.

Conclusion

In summary, TBL’s recent actions, including the sale of Darbrew Ltd, the upgrade of Kibo Breweries Ltd, and the revitalization of the Kilimanjaro Malting Plant, are pivotal to its strategic realignment and turnaround efforts. These initiatives are designed to address operational inefficiencies, improve financial performance, and capitalize on growth opportunities within Tanzania’s brewing and agricultural sectors.

The company’s ongoing commitment to enhancing its facilities, supporting local agriculture, and optimizing its investment portfolio demonstrates a proactive approach to overcoming challenges and positioning itself for long-term success. TBL’s strategic focus on revitalizing dormant assets and investing in key infrastructure reflects a broader effort to strengthen its market position and drive sustainable growth in the years ahead.

Zimbabwe’s 2024 budget deficit projected at 1.3% of GDP

Zimbabwe’s Finance Minister Mthuli Ncube revealed an updated economic forecast for the year 2024, projecting a budget deficit of 1.3% of Gross Domestic Product (GDP). This figure, while seemingly modest, is set against a backdrop of significant economic turbulence and environmental challenges that could influence the nation’s fiscal health. Ncube’s statements come amid mounting concerns about the adverse effects of a severe drought that has gripped southern Africa, bringing with it widespread financial and agricultural disruptions.

Revised Economic Growth Forecast Amid Severe Drought

In a notable shift from previous projections, the Ministry of Finance has revised the nation’s growth forecast for 2024 down to 2%, a substantial decrease from the earlier estimate of 3.5% provided in November. This downward revision reflects the profound impact of what is being described as the worst drought southern Africa has faced in decades. The severity of the drought has significantly impaired agricultural productivity, which is crucial to Zimbabwe’s economy.

The agricultural sector, which traditionally plays a pivotal role in the country’s economic framework, is now expected to contract by an alarming 21.2%. This represents a drastic worsening from the 4.9% contraction forecasted just months earlier. The drought has led to widespread crop failures and reduced yields, placing immense pressure on food security and economic stability. The cascading effects of this agricultural downturn are expected to ripple through other sectors, potentially leading to increased inflation and further economic strain.

Government Spending Priorities Under Review

In light of the deteriorating agricultural conditions, Ncube acknowledged that the government may need to revise its spending priorities for the remainder of the fiscal year. The immediate focus will likely shift towards mitigating the effects of the drought, including addressing issues related to food security and water scarcity. These adjustments are necessary to manage the fiscal impacts of the drought and ensure that critical needs are met.

The need for such recalibration underscores the volatile nature of economic management in Zimbabwe, where external factors such as environmental crises can swiftly alter financial projections and policy priorities. The government’s ability to adapt and reallocate resources in response to these challenges will be crucial in stabilizing the economy.

Introduction of the Zimbabwe Gold (ZiG) Currency

In a bid to stabilize the national currency and improve financial conditions, Zimbabwe launched its new gold-backed currency, the Zimbabwe Gold (ZiG), in April. This move represents the country’s sixth attempt to establish a stable domestic currency over the past 15 years. The introduction of the ZiG is part of a broader strategy to combat hyperinflation and restore confidence in Zimbabwe’s monetary system.

Ncube reported that since the launch of the ZiG, the economy has witnessed relatively stable prices and exchange rates. The new currency has managed to keep inflation in check over the initial two months since its introduction, which is a positive development given Zimbabwe’s historical struggles with currency volatility.

Despite these improvements, public uptake of the ZiG has been slow. Many Zimbabweans continue to favor foreign currencies, particularly US dollars, due to ongoing skepticism about the viability of the new currency. This resistance highlights the challenges faced in transitioning from a legacy of hyperinflation and currency instability to a more stable financial system.

Revised Tax Proposals to Encourage ZiG Adoption

To bolster the use of the ZiG and integrate it more fully into the economic framework, Ncube has introduced revised tax proposals. These changes are designed to incentivize transactions in the local currency and enhance its role in everyday economic activities. The new tax measures include adjustments to corporate tax regulations and mandates that some domestic taxes be paid exclusively in the ZiG.

The intent behind these proposals is to encourage greater circulation and acceptance of the ZiG, thereby fostering a more robust and stable currency environment. By aligning tax obligations with local currency usage, the government aims to boost confidence in the ZiG and facilitate a smoother transition away from reliance on foreign currencies.

Financial and Economic Implications

Zimbabwe’s current financial and economic landscape is shaped by a complex interplay of factors, including the severe drought, recent currency reforms, and evolving fiscal policies. The forecasted budget deficit of 1.3% of GDP, while manageable, reflects the broader challenges the country faces. The anticipated contraction in the agricultural sector and the need for revised spending priorities illustrate the immediate economic pressures that will influence fiscal policy and government actions in the near term.

The government’s efforts to stabilize the economy through currency reform and fiscal adjustments are critical steps in addressing both short-term disruptions and long-term financial stability. The slow adoption of the ZiG and the need for substantial agricultural recovery will be key factors in determining the success of these initiatives.

In summary, Zimbabwe’s economic strategy for 2024 is marked by a proactive response to immediate challenges and a forward-looking approach to currency stabilization. The government’s ability to navigate these complexities and implement effective policies will be instrumental in shaping the nation’s economic trajectory and ensuring a path toward recovery and growth.

South Africa’s new top diplomat: Impact on Palestine?

Late last year, South Africa made a significant move by bringing a case against Israel to the International Court of Justice (ICJ), a bold action spearheaded by its foreign ministry. Former Minister of International Relations and Cooperation, Naledi Pandor, was at the forefront of this initiative. In January, as the ICJ announced provisional measures in the case accusing Israel of committing genocide in its conflict with Gaza, Pandor was deeply involved, consulting with legal experts and representatives in The Hague.

Pandor, a seasoned diplomat with a long-standing commitment to human rights, publicly articulated the rationale behind South Africa’s legal action. “We could not stand idly by and continue to observe the killing of thousands of Palestinian civilians who had no role in the awful act of hostage-taking and killing,” she told reporters. Her statement underscored South Africa’s resolve to challenge what it viewed as severe injustices and to advocate for Palestinian rights on the global stage.

Now, with the recent national elections in May reshaping the South African political landscape, there has been a notable transition in the country’s foreign policy leadership. Ronald Lamola, previously the Minister of Justice, has assumed the role of Foreign Minister. Despite this significant shift, Lamola has made it clear that South Africa’s foreign policy stance will remain consistent.

In an interview with Al Jazeera, Lamola, who was sworn in as Foreign Minister on July 3, 2024, at the Cape Town International Convention Centre, stated unequivocally, “No,” when asked if South Africa’s foreign policy would change under his watch. The 40-year-old Lamola, who steps into this crucial role amidst a complex global and regional context, emphasized that his diplomatic approach will remain steadfast, undeterred by external pressures or global power dynamics. “We should not be bullied by anyone. We must be able to mediate in conflicts and advocate for human rights without external pressure,” Lamola asserted.

Lamola’s appointment comes at a pivotal moment for South Africa. The nation is actively engaged in holding Israel accountable for its actions in Gaza while also navigating ongoing conflicts across the African continent. This period of transition follows the retirement of Pandor and the establishment of a new Government of National Unity (GNU) last month. This government formation was necessitated by the centre-left African National Congress (ANC) losing its parliamentary majority for the first time in three decades and having to form a coalition to sustain its leadership.

As a senior leader of the ANC and a trusted ally of President Cyril Ramaphosa, Lamola inherits a role that involves managing complex international relationships and upholding South Africa’s foreign policy principles. His appointment signifies continuity in the country’s approach to global diplomacy, particularly regarding its stance on Israel and broader human rights issues.

However, the coalition government, which now includes diverse political parties with varying ideologies, presents a new dynamic in South Africa’s foreign policy landscape. The centre-right Democratic Alliance, a significant coalition partner, has adopted a neutral stance on Israel’s actions in Gaza, while the right-wing populist Patriotic Alliance has voiced support for Israel. Despite these ideological differences, Lamola has assured that South Africa’s principle of non-alignment in global conflicts will endure.

The GNU’s coalition agreement emphasizes a foreign policy anchored in human rights, constitutionalism, national interest, and multilateralism. Lamola has reaffirmed that these core principles will guide South Africa’s international diplomacy, ensuring that the country remains committed to advocating for justice and stability on the global stage.

while South Africa undergoes a period of political transition and coalition governance, its foreign policy remains anchored in its foundational values. Under the new Foreign Minister Ronald Lamola, the nation is poised to continue its active role in international diplomacy, addressing global conflicts and advocating for human rights with a consistent and principled approach.

Different style, same substance

As South Africa’s Foreign Minister, Naledi Pandor was renowned for her resolute stance against Israel and her assertive diplomatic approach. Pandor’s tenure was marked by her unwavering commitment to addressing international human rights violations and advocating for Palestinian rights on the global stage. A notable instance of her firm diplomatic posture was in January when, alongside South African Ambassador to the Netherlands Vusimuzi Madonsela, Pandor engaged with the International Court of Justice (ICJ) in The Hague. On that day, the ICJ ruled on emergency measures against Israel, following South Africa’s allegations that the Israeli military operations in Gaza constituted a state-led genocide.

Now, as South Africa transitions to a new phase in its international diplomacy, the country is preparing to continue its pursuit of justice against Israel at the ICJ. The court is set to deliberate on the merits of the case brought forth by South Africa, which accuses Israel of committing genocide. This case builds upon a separate instance where Israel was previously found responsible for apartheid.

In a statement reflecting South Africa’s ongoing commitment to this cause, new Foreign Minister Ronald Lamola emphasized, “South Africa will continue to advocate for holding Israel and individuals responsible for genocide accountable. We welcome the ongoing process led by the ICC prosecutor.” Lamola’s comments underscore South Africa’s steadfast approach to addressing and resolving international human rights issues.

During the initial hearings in January, while Lamola was serving as the Minister of Justice, he made it clear to the World Court that the violence in Palestine and Israel did not begin on October 7, 2023, but was part of a longstanding and complex conflict. This statement was a testament to Lamola’s understanding of the intricate historical and geopolitical context surrounding the Israeli-Palestinian conflict.

Foreign policy analyst Sanusha Naidu anticipates that Lamola will likely continue South Africa’s assertive stance on Palestinian issues, echoing Pandor’s previous approach. Naidu explained, “It’s all part of the broader framework of South Africa’s foreign policy as articulated by the ANC and the president.” This suggests that while Lamola may bring his unique style to the role, the foundational principles of South Africa’s foreign policy will remain unchanged.

Despite his relative youth and recent appointment, Lamola is no stranger to political contention. His political career includes notable moments such as his vocal criticism of former President Jacob Zuma amid a plethora of corruption allegations. Lamola’s courageous stance during a turbulent period was seen as politically risky but demonstrated his commitment to integrity and accountability.

Naidu remarked, “He is very young, but it is seen as Ramaphosa appointing him as someone he can rely on in the international stage.” This indicates that Lamola’s appointment is viewed as a strategic move by President Cyril Ramaphosa to ensure a reliable and principled representation of South Africa on the global stage.

While Lamola may introduce a different diplomatic style compared to his predecessor Pandor, Naidu believes that South Africa’s foreign policy will maintain its core principles. However, Naidu also noted that global developments, such as the upcoming United States election in November, will have significant implications for global geopolitics and could affect South Africa’s international relations.

In conclusion, as South Africa navigates this period of transition in its foreign policy leadership, the commitment to upholding human rights and justice remains central. With Ronald Lamola at the helm, the country is poised to continue its assertive and principled stance on global issues, ensuring that its foreign policy reflects both continuity and adaptability in a rapidly evolving international landscape.

African conflicts

For Ronald Lamola, South Africa’s newly appointed foreign minister, the immediate focus is on addressing critical issues within the African continent, with a particular emphasis on conflict resolution and peacebuilding.

Lamola has pledged his unwavering support for the African Union’s ambitious “Silencing the Guns” initiative, which aims to eradicate armed conflicts and achieve a conflict-free Africa by 2030. Despite these noble aspirations, the International Rescue Committee (IRC) has raised alarms about the escalating levels of violence, political instability, and poverty throughout Africa. The number of armed groups has surged dramatically in the past decade, more than doubling and exacerbating the region’s challenges.

South Africa is actively working to mediate the ongoing conflict in Sudan, a nation that has been ravaged by intense violence and instability. President Cyril Ramaphosa has personally engaged with both factions in the conflict, striving to bring them to the negotiating table in a bid to broker peace. “Sudan is a significant concern for the AU and was a pivotal topic in my discussions with Nigerian and Egyptian counterparts,” Lamola emphasized. He stressed the importance of convening all warring parties for dialogue as a crucial step toward a sustainable and lasting resolution.

The IRC’s reports underscore the gravity of the situation in Sudan, noting that over 11 million people are internally displaced, making it the world’s largest internal displacement crisis. This dire humanitarian crisis has put immense pressure on regional and international actors to find viable solutions.

Elizabeth Sidiropoulos, the head of the South African Institute of International Affairs, highlighted South Africa’s deep-seated interest in addressing conflicts across the continent, particularly in Southern Africa and the Great Lakes region. She pointed out that Lamola’s principal challenge will be to effectively leverage the country’s limited resources for both defense and diplomatic mediation. “The key challenge for the minister will be effectively utilizing our limited resources in both defense and diplomatic mediation for crucial conflicts on our continent,” Sidiropoulos noted.

As Lamola embarks on his tenure, his approach will be critical in navigating the complex landscape of African conflicts and advancing South Africa’s role as a key mediator and advocate for peace.

Economic diplomacy

Ronald Lamola, South Africa’s newly appointed foreign minister, has placed a strong emphasis on advancing economic diplomacy as a cornerstone of his agenda. He is ardently advocating for more favorable loan conditions for African nations, aiming to reshape the financial landscape to better support the continent’s development aspirations.

This focus on economic diplomacy comes at a critical juncture, with widespread protests erupting in Kenya against the high-interest loans provided by the International Monetary Fund (IMF) and other Western financial institutions. Many Kenyans believe that these loans, rather than alleviating economic difficulties, have only worsened their financial hardships, exacerbating the challenges faced by ordinary citizens.

The broader criticism leveled at multilateral lenders, particularly the IMF, is that their stringent loan conditions often place an undue burden on the most vulnerable populations. Over the years, these conditions have been seen as disproportionately harsh, leading to significant backlash across Africa. The criticism centers around the view that such conditions stifle economic growth and development, making it harder for countries to achieve sustainable progress.

In response, Lamola intends to leverage South Africa’s prominent global position, particularly with the upcoming presidency of the G20, to advocate for more favorable and equitable financing terms for African development projects. By using South Africa’s influential role on the world stage, Lamola seeks to negotiate terms that promote sustainable development while preserving national sovereignty.

“We advocate for financing conditions that support development without impairing sovereignty,” Lamola stated, underscoring his commitment to securing loans that not only drive progress but also respect the autonomy of African nations.

His approach aims to address the imbalance in international financial agreements and ensure that the economic support provided aligns with the developmental goals and sovereignty of African countries.