Regional Businesses Shift to Kenyan Market

In a notable shift in regional economic dynamics, businesses from the East African Community (EAC) are significantly expanding their operations into Kenya’s critical sectors, such as services, manufacturing, agriculture, oil, and gas. This development represents a dramatic departure from the historical trend where Kenyan enterprises have predominantly led the charge into the EAC markets. Instead, we are witnessing a growing influx of investment from neighboring EAC countries including Uganda, Tanzania, Rwanda, and Somalia, which is beginning to challenge the traditional dominance held by Kenyan firms and those from outside the region.

The heightened activity of regional firms like Amsons Group, Taifa Gas, Maziwa, Premier Bank, Yego Global, and Liptons Teas and Infusions Rwanda underscores this significant shift. These companies are not merely entering the Kenyan market; they are making substantial investments that could reshape various industries within the country. This strategic expansion by EAC firms follows years of Kenyan businesses venturing into regional markets, seeking new opportunities and growth beyond their borders.

At the end of 2021, the EAC region had an economy valued at $312.9 billion and a population of approximately 300.4 million people, as reported by the trade bloc. This substantial economic backdrop has increasingly attracted EAC companies to Kenya, capitalizing on its growing market potential.

One of the most recent and high-profile examples of this trend is the Tanzanian conglomerate Amsons Group’s bid to acquire Bamburi Cement. Announced last week, Amsons Group’s formal takeover bid for Bamburi Cement, valued at Sh23.59 billion (around $183 million), represents a bold move into Kenya’s competitive cement industry. This acquisition aims to elevate Bamburi Cement’s standing as a leading player in the East African cement market, setting the stage for intensified competition with established local cement producers such as National Cement Company, Mombasa Cement, and East Africa Portland Cement Company. Amsons Group’s commitment to strengthening Bamburi’s market position reflects a strategic intent to gain a significant foothold in Kenya’s thriving construction and infrastructure sector.

The acquisition by Amsons Group is particularly noteworthy given its timing, just three months after Uganda’s Pearl Dairy Farms, a prominent player known for its popular Lato brand, secured approval to acquire a Kenyan dairy company. This strategic move is set to alleviate challenges related to the supply and sale of Pearl Dairy’s products in Kenya. The Comesa Competition Commission’s approval of Pearl Dairy’s acquisition of a 100% stake in Highland Creamers & Food Limited, a Kisii-based company behind the Farmily Milk brand, marks a significant development in the regional dairy industry.

Pearl Dairy Farms emphasized that this acquisition will facilitate access to both Kenyan and Ugandan milk pools, thereby enabling growth in the local Kenyan market without reliance on imports from other countries. This move not only addresses supply chain challenges but also positions Pearl Dairy to enhance its market presence in Kenya. Additionally, Pearl Dairy’s partnership with the State-owned Kenya Development Corporation (KDC) to invest jointly in local dairy ventures signals the potential for further expansions and investments in Kenya’s dairy sector, strengthening its competitive edge.

Another notable development is the entry of Taifa Gas Investment, a leading Tanzanian supplier of liquefied petroleum gas (LPG), into the Kenyan market. Taifa Gas is in the process of constructing a significant 30,000-tonne LPG import and storage terminal in Mombasa. This project highlights the benefits of improving trade relations between Tanzania and Kenya and demonstrates Taifa Gas’s strategic move to capitalize on Kenya’s growing energy sector. The establishment of this terminal is expected to bolster Kenya’s LPG infrastructure and enhance supply capabilities, reflecting the positive impact of regional economic integration.

The influx of EAC businesses into Kenya represents a transformative shift in the regional economic landscape. This increased competition and investment are reshaping Kenya’s market dynamics, challenging the historical dominance of local and external players, and signaling a new era of regional economic collaboration. As EAC firms continue to expand their presence in Kenya, the country is likely to experience a wave of innovation, increased competition, and enhanced investment that will contribute to its economic growth and development. This evolving trend underscores the growing interconnectedness of the East African region and highlights the importance of strategic regional partnerships in driving future economic success.

Three Banks Exit, Five New Banks Join Kenya’s Oil Import Deal

In a significant development within Kenya’s financial and energy sectors, three prominent Kenyan banks have withdrawn from the government’s high-stakes $500 million monthly oil import deal with two Gulf states. This major shift involves NCBA Group Plc, Absa Bank Kenya Plc, and Co-operative Bank exiting the deal, which has been pivotal in addressing the country’s dollar liquidity challenges. Their departure has cleared the way for new entrants including Equity Group, United Bank of Africa, Diamond Trust Bank, I&M Bank, and Pakistan’s MCB to vie for a stake in this lucrative arrangement.

The oil import agreement, which was established in March 2023 through a collaborative effort between the Kenyan government, the United Arab Emirates (UAE), and Saudi Arabia, was designed to mitigate the severe shortage of U.S. dollars in the Kenyan economy and stabilize the foreign exchange market. This deal extended the credit period for importing petroleum products from a standard 30 days to an extended 180 days. By doing so, it aimed to ease the pressure on Kenya’s forex reserves and provide a critical financial lifeline to the country amid economic turbulence.

The Energy and Petroleum Regulatory Authority (Epra) recently disclosed that NCBA, Absa Bank, and Co-operative Bank have exited the deal. This has led to the introduction of new banking players into the arrangement, including Equity Group, United Bank of Africa, Diamond Trust Bank, I&M Bank, and Pakistan’s MCB. These banks are stepping in as key players in the financing of oil imports, a sector that has become increasingly competitive due to the strategic importance of the deal.

The selection of banks for this oil import deal was never a guarantee of business success. Despite being included in the initial roster, the three exiting banks faced stiff competition for the issuance of letters of credit (LCs) from the four major local oil importers: Gulf Energy, Galana Energies Ltd, Asharami Energy, and One Petroleum Ltd. Industry insiders have noted that the banks struggled to secure contracts due to intense competition among financial institutions for this highly coveted business.

A letter of credit is a critical financial instrument used in international trade, providing a guarantee from a bank to a supplier that payment will be made on behalf of an importer. The recent developments indicate that the exiting banks were unable to secure any substantial LCs from the importers, suggesting they could not compete effectively in the new, highly competitive environment.

In stark contrast, KCB Bank has demonstrated its significant role in the deal. As of November 2023, KCB Bank revealed that it had cumulatively guaranteed fuel import purchases worth an impressive $3.37 billion since the inception of the government-to-government deal. This substantial involvement underscores KCB’s robust capacity and influential role in supporting the arrangement with major oil suppliers, including Saudi Aramco, Abu Dhabi National Oil Corporation, and Emirates National Oil Company. This support has been integral to the deal’s success and highlights KCB’s dominance in this competitive sector.

Paul Russo, CEO of KCB Group, has articulated the bank’s strategic focus on developing expertise in oil and gas, strengthening its trade finance capabilities, and building strong relationships with international financial institutions. “The success of this business hinges on three core areas: oil and gas expertise, a well-structured trade finance segment, and solid financial relationships with counterparties,” Russo emphasized in a detailed interview on July 16.

Despite the substantial changes, NCBA and Co-operative Bank have not provided public comments on their exit from the deal, as they did not respond to inquiries from the media.

The initial selection of banks for the oil import deal, made in March 2023, included a consortium of five local banks: KCB, NCBA, Absa Bank Kenya, Stanbic Bank, and Co-operative Bank, along with Africa Export-Import Bank (Afreximbank). These institutions were tasked with issuing letters of credit up to $4.8 billion for fuel imports from the UAE, intended to cover a nine-month period. This arrangement was a critical measure implemented by the Kenyan government to mitigate economic risks related to dollar liquidity constraints, which were pressing at the time.

By extending the credit period and avoiding the spot market for fuel purchases, the scheme was designed to alleviate pressures on Kenya’s forex reserves. Prior to this arrangement, oil marketing companies faced a monthly demand for $500 million to cover their import bills under the Open Tender System (OTS). The scheme not only aimed to ease this financial burden but also sought to provide stability and reduce the immediate demand for foreign currency.

The initial nine-month arrangement, which concluded in December 2023, has been extended for an additional 12 months, continuing through December of this year. This extension underscores the ongoing importance of the deal in stabilizing Kenya’s foreign exchange situation and highlights the evolving competitive landscape within the banking and energy sectors. The shifting dynamics reflect broader trends in regional economic integration and the strategic importance of managing international trade and financial arrangements effectively.

EAC, Comesa, and Sadc Merge into Seamless Market

Starting July 25, 2024, a major milestone will be achieved in East, Central, and Southern Africa as 14 countries commence free trade under the newly ratified Tripartite Free Trade Area (TFTA) Agreement. This transformative agreement, which merges the East African Community (EAC), the Southern African Development Community (Sadc), and the Common Market for Eastern and Southern Africa (Comesa) into a single, cohesive commerce bloc, marks a significant step in regional integration and economic cooperation.

The TFTA, which required ratification from a minimum of 14 out of the 29 participating states, has now met this threshold, thanks to recent ratifications by Malawi, Lesotho, and Angola. With these additions, the total number of ratifying countries stands at 14. This includes key members such as Kenya, Rwanda, and Uganda, who were among the early adopters. However, ratification is still pending for the Democratic Republic of Congo and Tanzania, which are expected to join the agreement shortly.

The TFTA represents a groundbreaking effort to streamline trade by eliminating tariff barriers and reducing non-tariff obstacles. This integration aims to address the complexities and inefficiencies associated with overlapping regional economic communities. By harmonizing trade regulations and facilitating easier movement of goods and services, the TFTA seeks to enhance economic growth and regional cooperation.

A key feature of the TFTA is its commitment to the full liberalization of tariff lines, setting an ambitious target compared to the African Continental Free Trade Area (AfCFTA). While the AfCFTA targets 90% tariff liberalization for non-sensitive products, 7% for sensitive products, and 3% for exclusion lists, the TFTA aims for a more comprehensive 100% tariff liberalization. This ambitious goal will see 60% to 85% of tariff lines liberalized upon the agreement’s activation, with negotiations to address the remaining 15% to 40% of tariff lines over the next five to eight years.

Despite these promising advancements, the TFTA faces several challenges that need to be addressed for its full operationalization. One major challenge is the absence of a dedicated secretariat to coordinate and implement the TFTA’s various programs and activities. Currently, coordination is managed on a rotational basis among the three regional economic communities (RECs), which is not sustainable for long-term effectiveness. Establishing a permanent regional headquarters is a critical next step for effective coordination.

Financial constraints also pose a significant obstacle. The negotiations and implementation of the TFTA’s different pillars have been slowed down by inadequate funding. The RECs rely heavily on their own staff and resources, with only the market integration pillar currently receiving support from the African Development Bank. This limited financial backing has impeded progress in other crucial areas, such as infrastructure and industrial development, which are essential for fostering sustainable trade and economic development.

The TFTA, which was officially signed in 2015, covers 29 countries representing a substantial portion of the African continent. These member states collectively account for 53% of the African Union’s membership, over 60% of the continent’s GDP (approximately $1.88 trillion as of 2019), and a combined population of 800 million. The agreement is poised to reshape the economic landscape of the region, offering new opportunities for intra-African trade and investment.

In summary, the launch of the Tripartite Free Trade Area marks a pivotal moment for regional integration in Africa. It holds the promise of reducing trade barriers, enhancing economic cooperation, and fostering growth across East, Central, and Southern Africa. However, addressing the challenges of coordination and financing will be crucial for realizing the full potential of this ambitious initiative.

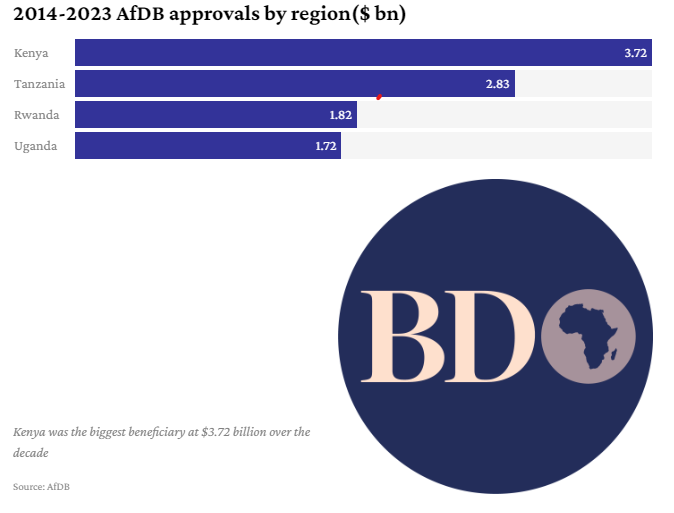

Kenya top recipient of AfDB funding in East Africa

Kenya stands as the leading recipient of funding from the African Development Bank (AfDB) within the East and Central African region over the past decade. Data from the pan-African financial institution reveals that between 2013 and 2023, AfDB approved a substantial total of $3.718 billion (equivalent to UA2.77 billion) for Kenya. This amount surpasses the funding allocated to its regional counterparts, with Tanzania receiving $2.83 billion (UA2.11 billion) and Rwanda securing $1.81 billion (UA1.35 billion).

The AfDB’s currency of trade, known as the Unit of Account (UA), fluctuates in its exchange rate with the U.S. dollar. For instance, in the previous year, one UA was valued at $1.3416. This variation underscores the scale of Kenya’s funding, reflecting the significant investment the country has attracted from the AfDB.

Key sectors benefiting from this funding include energy, road construction, and water. These sectors have been critical in advancing Kenya’s infrastructure and development goals, cementing the AfDB’s role as a vital development partner. The bank’s support has been instrumental in financing major projects such as the 300-megawatt Lake Turkana Wind Power Project—recognized as Africa’s largest wind farm—the ongoing Last Mile Connectivity electricity initiative, and the Sh16.7 billion dualing of the Kenol-Sagana-Marua Road.

According to AfDB’s annual report, approvals for East Africa reached UA2.29 billion, representing 29 percent of the total approvals for the period. This reflects a substantial 37 percent increase from UA1.67 billion in 2022, underscoring the growing significance of AfDB’s investments in the region.

Kenya, much like other African nations, has increasingly relied on AfDB for substantial funding across various sectors. The AfDB, which exclusively lends to African countries, is owned 60 percent by African member states and the remaining 40 percent by non-African stakeholders, including the U.S., Japan, and India. The bank’s financial support comes in various forms, including grants, loans, guarantees, and the Transition Support Facility for economies in distress. This approach highlights AfDB’s commitment to reducing Africa’s dependence on traditional international financiers like the World Bank and International Monetary Fund (IMF).

The surge in AfDB’s funding to Kenya began around 2013, coinciding with the administration of former President Uhuru Kenyatta. During this period, AfDB’s role as a key financier for the Kenyan government has solidified, positioning it alongside the World Bank and IMF in terms of financial support.

Notably, 2016 marked Kenya’s most successful year in terms of AfDB funding, with the country receiving $823.26 million (UA612.4 million). This peak in funding reflects the significant impact of AfDB’s investments on Kenya’s development trajectory.

Kenya’s relationship with AfDB dates back to January 1964 when the country became a member. Over the decades, Kenya has grown to become one of AfDB’s top 20 member states. However, this increased involvement has also led to heightened scrutiny. Several local firms in Kenya have faced bans from AfDB for periods of up to three years due to issues of corruption and unethical practices in securing tenders. Notable among these banned firms are Beta Trading Company, Global Interjapan (Kenya) Limited, Eva-Top Agencies, and Madujey Global Services.

The ongoing engagement between Kenya and AfDB illustrates the critical role of regional and international financial institutions in supporting national development agendas and highlights the challenges associated with managing large-scale funding and ensuring transparency.