Exploring Ethiopia’s Adoption of a Market-Based FX System Amid Debt Default and Devaluation Challenges

Ethiopia Becomes Third African State to Default on Debt

Ethiopia has now joined the ranks of Africa’s sovereign debt defaulters, marking its place as the continent’s third such case in recent years, after it failed to make a critical $33 million “coupon” payment on its lone international government bond. This default, a significant and concerning development, underscores the severe economic challenges and financial instability that Ethiopia currently faces.

Ethiopia, the second most populous nation in Africa, formally announced its intention to default on its debt obligations. The country has been under immense financial strain, struggling to cope with the dual impacts of the Covid-19 pandemic and a brutal two-year civil war that concluded in November 2022. These two crises have collectively placed unprecedented stress on Ethiopia’s economy, draining its foreign exchange reserves and causing inflation to skyrocket, thereby exacerbating the nation’s financial difficulties.

Initially, Ethiopia was supposed to make the payment on December 11 2023. However, due to a 14-day grace period clause written into the $1 billion bond, the country technically had until December 25 2023 to fulfill its financial obligation. Despite this extension, by the end of the business day, December 22, the last international banking working day before the expiration of the grace period, bondholders had not received the expected payment. According to sources familiar with the situation, the failure to make the payment indicated an impending default, a scenario that had been widely anticipated by financial analysts and investors.

Government officials from Ethiopia did not respond to requests for comment over the weekend or in the days leading up to the final deadline. The absence of official communication and the widely expected default signal a significant financial crisis for Ethiopia. This default now places Ethiopia alongside Zambia and Ghana, which have also entered full-scale “Common Framework” restructurings. These restructurings are part of a G20-led initiative aimed at coordinating debt relief efforts among creditors for low-income countries facing severe financial distress.

Ethiopia’s journey towards this default began in early 2021, when it first sought debt relief under the G20’s Common Framework initiative. However, the progress of this request was initially delayed due to the ongoing civil war within the country. The conflict, which ravaged the northern region of Tigray, disrupted economic activities and diverted resources away from economic stabilization efforts. Despite the cessation of hostilities in November 2022, Ethiopia’s economic situation remained dire. The country’s foreign exchange reserves were critically depleted, and inflation continued to soar, creating immense pressure on the government’s finances and its ability to meet international financial obligations.

In a bid to stabilize the economy and manage its debt burden, Ethiopia’s official sector government creditors, including China, agreed to a debt service suspension deal in November 2022. This agreement provided temporary relief by suspending debt payments, but it did not address the root causes of Ethiopia’s financial crisis. The country’s economic woes were further compounded by failed negotiations with pension funds and other private sector creditors holding its bond. On December 8 2023, the Ethiopian government announced that these parallel negotiations had broken down, eliminating any hope of a private sector-led resolution. This failure left Ethiopia with no viable path to avoid default.

The breakdown in negotiations and the imminent default prompted credit ratings agency S&P Global to downgrade Ethiopia’s bond to “Default” on December 15 2023. This downgrade was based on the assumption that the coupon payment would not be made, reflecting the severe financial instability and lack of confidence in Ethiopia’s ability to honor its debt obligations. The downgrade by S&P Global underscores the gravity of Ethiopia’s financial situation and the broader implications for the country’s economic future.

Ethiopia’s default on its international government bond payment highlights the broader challenges faced by many African nations grappling with the economic fallout from the Covid-19 pandemic and internal conflicts. The country’s experience serves as a stark reminder of the vulnerabilities of low-income countries to external shocks and internal strife. The need for comprehensive and coordinated debt relief efforts is more critical than ever to support these nations in navigating their economic challenges. The G20’s Common Framework initiative represents a step towards addressing these issues, but Ethiopia’s situation demonstrates the complexities and difficulties of implementing effective debt relief measures.

As Ethiopia navigates this period of economic turmoil, the international community will be closely monitoring how the country manages its default and restructures its debt. The outcome of this process will have significant implications for Ethiopia’s economic stability and growth, as well as for other nations facing similar challenges. The path ahead for Ethiopia is fraught with difficulties, but it also presents an opportunity for the country to implement necessary reforms and rebuild its economy on a more sustainable footing.

The context of Ethiopia’s financial crisis is deeply rooted in its recent economic history. On December 20, 2019, the IMF Board approved a three-year arrangement under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) for Ethiopia, worth about $2.9 billion. This arrangement was designed to help the country implement its Homegrown Economic Reform Plan, maintain macroeconomic stability, and improve living standards. However, the programme was suspended due to the outbreak of conflict in the northern region of Tigray. The ensuing violence and instability caused significant disruptions to the economy and delayed the implementation of critical reforms. Negotiations with the IMF and World Bank resumed after a peace deal was reached in November 2022, paving the way for the resumption of financial support and the continuation of economic reforms.

In the wake of a financial crisis triggered by the Covid-19 pandemic and the two-year war in Tigray, Ethiopia defaulted on a $33 million coupon payment on its Eurobond. This default placed Ethiopia alongside other African nations, such as Zambia and Ghana, which have also struggled to meet their external financial obligations. As of March 31, 2024, Ethiopia’s public debt stood at $65.82 billion, according to the country’s Finance Ministry. The total external debt increased by 0.5 percent to $28.38 billion from $28.24 billion as of June 30, 2023, reflecting the ongoing financial challenges facing the country.

The comprehensive reforms announced by the National Bank of Ethiopia (NBE) represent a significant shift in Ethiopia’s economic policy. By embracing a market-based exchange rate system and liberalizing foreign exchange regulations, the government aims to tackle the root causes of its economic challenges. These changes are expected to enhance foreign currency inflows, stimulate economic activity, and pave the way for sustainable development. However, the successful implementation of these reforms will require careful management, strong institutional support, and ongoing collaboration with international financial institutions and the global community.

In conclusion, Ethiopia’s default on its international government bond payment is a stark reminder of the profound economic challenges that can arise from a combination of pandemic-induced financial strain and internal conflict. The failure to make the $33 million coupon payment within the grace period underscores the severity of the situation and the urgent need for coordinated international support to help the country stabilize and recover. As Ethiopia embarks on the difficult journey of debt restructuring, the lessons learned from this experience will be critical for informing future efforts to support economically vulnerable nations. The path ahead for Ethiopia is challenging, but with the right support and reforms, there is hope for a more stable and prosperous future.

Ethiopia Weighs Devaluation for IMF Bailout

Ethiopia finds itself at a crucial turning point as it grapples with the urgent need to consider a substantial devaluation of its currency, the birr, to secure a vital rescue loan from the International Monetary Fund (IMF). This critical situation follows the IMF’s recent departure from the country without reaching a crucial agreement, leaving Ethiopia in a precarious economic position. The East African nation, which holds the distinction of being Africa’s second most populous country, has been struggling under the weight of severe financial difficulties, including rampant inflation and a significant debt default that occurred in December. This default marked Ethiopia as the third African nation in as many years to default on its debt, highlighting a broader trend of economic instability across the continent.

Since 2020, Ethiopia has been without IMF financial assistance, and its previous lending arrangement with the Fund unraveled in 2021. The federal government, along with a rebellious regional authority, reached a peace agreement in late 2022 to end a protracted and devastating two-year civil conflict. Despite this peace accord, the country’s economic woes have continued, exacerbated by the financial repercussions of the pandemic and ongoing economic strain. While the IMF has acknowledged some progress during its recent visit to Ethiopia, it has yet to specify that currency reform is a prerequisite for future support. However, given the IMF’s general preference for flexible, market-determined exchange rates, it is likely that a significant devaluation of the birr could be necessary for Ethiopia to secure the required financial support.

Ethiopia’s economic landscape is marked by chronic shortages of foreign currency, coupled with a tightly controlled exchange rate that has fueled a burgeoning black market. On this unofficial market, the birr trades at between 117 and 120 per dollar—substantially higher than the official rate of approximately 56.7. This disparity underscores the urgent need for a comprehensive overhaul of the currency system to stabilize the economy and address the imbalance between the official and market rates. Ethiopia has formally requested $3.5 billion in support from the IMF, according to sources reported by Reuters last year.

Economic analysts, including Abdulmenan Mohammed, have underscored the significant challenges facing Ethiopian authorities as they attempt to meet the IMF’s demands. The potential for devaluing the birr raises serious concerns about possible negative economic consequences, such as exacerbated inflation and an increased burden of foreign currency-denominated debts when measured in birr. These concerns place Ethiopian policymakers in a difficult position, as they must balance the potential economic impact of devaluation against the need to secure financial support and stabilize the country’s economy.

In early 2021, Ethiopia sought debt restructuring under the G20’s Common Framework—a debt relief mechanism established in response to the COVID-19 pandemic to include newer creditor countries like China and India in debt negotiations. However, progress was initially stalled by the ongoing civil conflict. As of the end of March, Ethiopia’s external debt had reached $28.2 billion, according to government data. In August 2023, Ethiopia secured a suspension of debt payments from its largest bilateral creditor, China, which had previously committed to lending the country $14 billion from 2006 to 2022. Following this, other bilateral creditors agreed to extend debt relief in December, contingent upon Ethiopia securing an IMF deal by March 31 2024. This deadline was subsequently extended to June 30 2024.

The scale of the currency devaluation required to secure an IMF agreement is subject to varying estimates. Irmgard Erasmus of Oxford Economics anticipates that a devaluation of approximately 15 percent might align with an IMF staff-level agreement on a bailout loan, which is a prerequisite for progressing with external debt restructuring. Erasmus suggests that the IMF will require a clear demonstration of Ethiopia’s commitment to adopting a more flexible foreign exchange regime. This commitment would set the stage for a series of gradual devaluations, ultimately leading to full foreign exchange liberalization and broader monetary policy reforms.

Connor Vasey, a consultant at J.S. Held, proposes that Ethiopia may need to implement multiple currency adjustments, with an initial devaluation ranging between 30 and 50 percent. He draws a comparison with Egypt, which devalued its pound by 38 percent and subsequently secured a larger IMF loan in March. Vasey notes that while Ethiopian authorities might prefer a more gradual approach to devaluation, their negotiating position is weakened by the expiration of the previous IMF loan program in 2021, coupled with the conflict and concerns about the country’s ability to meet its debt obligations. “Ethiopia is entering negotiations with the IMF under very challenging circumstances,” Vasey observes. “The IMF is adopting a tough stance, indicating that Ethiopia has limited leverage in negotiating more favorable terms.”

Despite these challenges, Vasey remains optimistic that Ethiopia will secure an IMF deal in the near future, citing a strong international push to finalize the necessary reforms. An IMF spokesperson referred to earlier comments by Julie Kozack, who acknowledged the substantial progress made during recent discussions and indicated that these discussions would continue at the IMF’s upcoming Spring Meetings.

Ethiopian government officials have not responded to requests for comment. However, state finance minister Eyob Tekalign reaffirmed the government’s commitment to foreign exchange reform in October 2022. Tekalign emphasized that “exchange rate unification remains one important policy goal,” although the government intends to implement it gradually to mitigate potential economic shocks.

As Ethiopia navigates this critical period, the decisions made in the coming months will be pivotal in shaping the country’s financial stability and long-term economic prospects. The interplay between the need for immediate financial relief and the challenges of implementing significant economic reforms will define Ethiopia’s path forward, influencing both its economic recovery and its standing in the international financial community. The process of currency devaluation, along with broader economic reforms, will play a crucial role in determining the future trajectory of Ethiopia’s economic landscape.

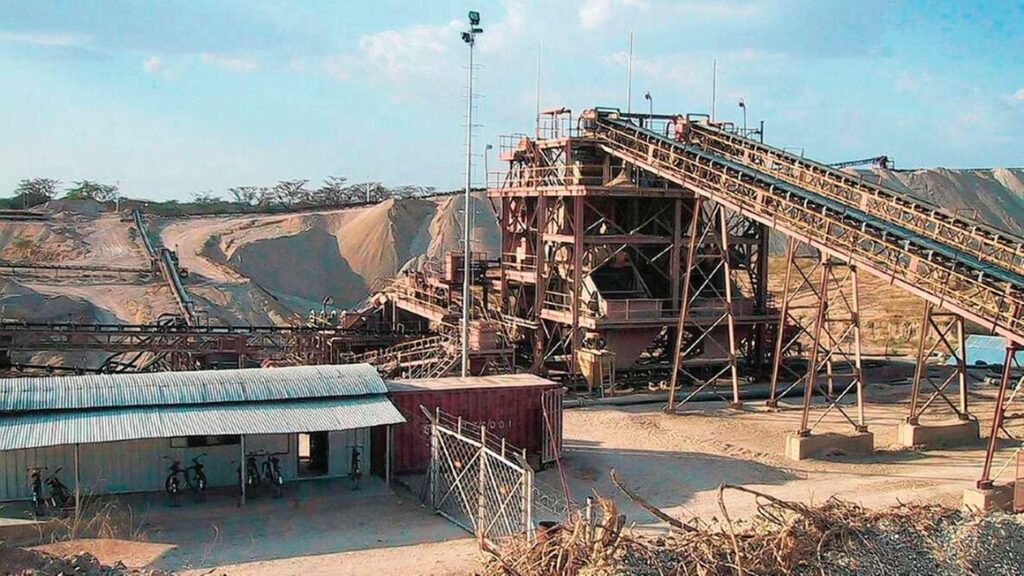

Tanzania Settles $90M Mining Dispute with Australian Investor

Tanzania has successfully negotiated an out-of-court settlement with the Australian mining company Indiana Resources, agreeing to a substantial payment of $90 million to bring an end to arbitration proceedings at the International Centre for Settlement of Investment Disputes (ICSID). This significant agreement marks a potential conclusion to a long-standing and contentious dispute, highlighting a pivotal moment in the ongoing saga between the East African nation and the mining giant.

The dispute, which has been a thorn in the side of both parties, initially saw the ICSID order Tanzania to pay a hefty sum of $109 million to Indiana Resources in July 2023. This ruling came after the tribunal determined that Tanzania had unlawfully expropriated Indiana’s licence to conduct nickel mining operations within the country. The ICSID’s decision underscored the gravity of the situation, indicating a clear breach of investment agreements and international law on Tanzania’s part.

Despite the original award, the negotiated settlement amount of $90 million, while significant, is notably less than the ICSID’s ordered payment. This difference is a testament to the complex negotiations and legal strategies employed by both sides. Indiana Resources, in a statement, articulated that this settlement would spare the company from further time-consuming and costly legal battles to secure the full award. By last week, the total amount due had ballooned to $121 million, accruing interest at an alarming rate of $1 million per month. This escalating financial pressure added another layer of urgency to the settlement negotiations.

Tanzania, on its part, had been strategically delaying the payment while seeking an annulment of the award through extended proceedings at the World Bank-affiliated tribunal. This legal maneuvering aimed at reducing or nullifying the financial burden on the nation, was a clear indication of the high stakes involved. Indiana Resources indicated that these proceedings would only reach a definitive conclusion once it receives the full settlement sum.

The agreement, finalized on July 29, stipulates that the $90 million settlement will be disbursed in three instalments. Demonstrating its commitment to the settlement, Tanzania has already made the first payment of $35 million. The subsequent payments are scheduled with $25 million due by October 25 and the final instalment of $30 million to be paid by the end of March 2025. This structured payment plan provides a clear timeline and financial roadmap for both parties, aiming to ensure compliance and transparency.

Bronwyn Barnes, the executive chairman of Indiana Resources, emphasized that the company retains the right to “recommence” the annulment process at ICSID if Tanzania defaults on any of the agreed subsequent payments. This provision acts as a safeguard for Indiana Resources, ensuring that it retains leverage and legal recourse should Tanzania fail to adhere to the payment schedule. Ms. Barnes further highlighted the company’s right to pursue enforcement activities, which could involve the seizure of Tanzania’s assets in any jurisdiction that is a member of the World Bank. This stern warning underscores the potential international implications of non-compliance by Tanzania.

In anticipation of this significant settlement, Indiana Resources secured a temporary suspension of trading on its shares from the Australian Securities Exchange earlier this month. This strategic move was aimed at stabilizing the company’s stock in light of the expected settlement with Tanzania, with the suspension deadline set for July 29.

This settlement is not an isolated incident but rather part of a broader trend. It marks the second such agreement between Tanzania and international firms that filed for ICSID arbitration following the controversial revocation of their mining licences by the administration of the late President John Magufuli in 2018. This policy, rooted in a wave of new mining laws, sought to assert Tanzania’s sovereign control over its mineral resources by scrapping retention licences for foreign investors. The Magufuli administration’s actions were justified on the grounds of national interest and resource nationalism, aiming to ensure that the country’s vast mineral wealth benefited its citizens.

In October 2023, Tanzania similarly resolved a dispute with Canadian firm Winshear Gold Corp through a one-time payment of $30 million. This out-of-court settlement concluded a case where Winshear had been claiming at least $96 million in damages for the expropriation of its retention licence for a gold mining project in southwestern Tanzania. This settlement, like the one with Indiana Resources, highlighted Tanzania’s pragmatic approach to resolving international disputes while managing its financial liabilities.

Moreover, a third Canadian company, Montero Mining and Exploration Ltd, is currently pursuing a claim against Tanzania at ICSID for $67 million. This claim seeks compensation for the cancellation of Montero’s licence to operate a rare earth element project in the Morogoro region. The case remains pending at the Washington DC-based tribunal, with the last mention occurring in January this year. The outcome of this case could further influence Tanzania’s legal and financial landscape in the mining sector.

The series of settlements and ongoing disputes reflect the broader challenges and complexities that Tanzania faces in balancing its sovereign interests with the obligations and expectations of international investors. These cases serve as a cautionary tale for other nations navigating the intricate dynamics of resource nationalism and foreign investment.

In conclusion, the $90 million settlement between Tanzania and Indiana Resources represents a critical juncture in their protracted dispute, with far-reaching implications for both parties. This agreement not only underscores the importance of strategic negotiation and legal acumen but also highlights the broader economic and political challenges that arise in the context of international investment and resource management. As Tanzania continues to navigate these complex waters, the outcomes of such settlements will undoubtedly shape its future relations with international investors and its position on the global stage.

Ethiopia Adopts Market-Based FX System, Devalues Birr

The National Bank of Ethiopia (NBE) has taken a bold and unprecedented step by allowing market forces to determine the value of its currency, the birr, and easing longstanding restrictions on the amount of foreign currency held by commercial banks and exporters. This sweeping set of reforms is part of a comprehensive package aimed at increasing the supply of dollars, boosting economic activity, and addressing the severe hard currency shortages that have plagued Ethiopia. These reforms come at a crucial time as the country grapples with rising inflation and mounting economic pressures.

Prime Minister Abiy Ahmed’s administration is under increasing pressure from international financial institutions, including the World Bank and International Monetary Fund (IMF), to implement critical reforms in the foreign exchange market. These reforms are seen as essential for unlocking over $10 billion in fresh funding, which is pivotal for Ethiopia’s economic stability and growth. The IMF and World Bank have stipulated these reforms as conditions for their financial support, highlighting the urgency and necessity of Ethiopia’s economic overhaul.

In a landmark announcement on Monday, the NBE detailed a series of transformative reforms designed to overhaul the country’s foreign exchange market. These include opening the proposed stock market to foreign investors, introducing non-bank foreign exchange bureaus to facilitate the buying and selling of foreign currency, and removing restrictions on the amount of dollars that travelers can take in and out of the country. This move signifies a shift towards greater economic liberalization and integration with the global financial system.

“The reform introduces a competitive, market-based determination of the exchange rate and addresses a long-standing distortion within the Ethiopian economy,” the NBE stated in its announcement. “Ethiopia’s foreign exchange reform is just one part of a wider package of economic reforms that are being implemented and accelerated over the coming months.”

The immediate impact of these reforms was evident on July 29, when the birr depreciated by 30 percent against the dollar, falling to 74.73 per dollar from 57.48 on July 26, following the lifting of trading restrictions. This sharp depreciation underscores the significant adjustment process that the Ethiopian economy will undergo as it transitions to a market-determined exchange rate.

The reform package is deeply rooted in Ethiopia’s Home-Grown Economic Reform Plan (HGER 2.0), which aims to restore macroeconomic stability, stimulate private sector activity, and ensure sustainable, broad-based, and inclusive growth. This ambitious plan outlines a roadmap for economic transformation, focusing on enhancing productivity, increasing investment, and fostering innovation across various sectors of the economy.

“The foreign exchange reforms being announced today involve significant new policy changes,” the central bank elaborated. “These include a shift to a market-based exchange regime where banks are now permitted to buy and sell foreign currencies from/to their clients and among themselves at freely negotiated rates. The NBE will make only limited interventions to support the market in its early days and if justified by disorderly market conditions.”

A cornerstone of the reforms is the policy change that allows foreign exchange to be retained by exporters and commercial banks. This measure is expected to significantly increase the supply of foreign exchange to the private sector, which has been starved of hard currency. By eliminating the previous requirement for foreign exchange surrender to the NBE, the reforms aim to create a more dynamic and responsive foreign exchange market.

Additionally, the NBE has removed import restrictions that previously prohibited 38 product categories. This move towards broader liberalization of the foreign exchange market for goods and services imports is expected to boost economic activity by allowing businesses to access the foreign exchange needed to import essential goods and services. However, it is important to note that capital account outflows remain restricted, maintaining a degree of control over external financial transactions.

The rules for the allocation of foreign exchange by banks, which were previously based on a waiting list system for different categories of imports, have been abolished. This change aims to streamline the process and reduce bureaucratic hurdles, thereby facilitating smoother and more efficient foreign exchange transactions. Furthermore, the foreign exchange retention rules for exporters have been improved, allowing them to retain 50 percent of their foreign exchange proceeds, up from the previous 40 percent. This increase is expected to incentivize exporters and enhance their capacity to reinvest in their operations.

The NBE has also simplified the rules for foreign currency accounts, particularly those held by foreign institutions, foreign direct investors, and the Ethiopian diaspora. Residents are now permitted to open foreign currency accounts based on remittances, transfers from abroad, foreign exchange-based salary or rental income, and other specified cases. These accounts can be used for payments for foreign services, providing greater flexibility and financial freedom for residents and businesses alike.

Additional measures include the removal of interest rate ceilings that previously applied to private companies or banks when borrowing from abroad. This deregulation is expected to facilitate greater access to international capital and financing, supporting investment and economic growth. The Ethiopian securities market is now open to foreign investors under terms and conditions that will be specified later, marking a significant step towards integrating Ethiopia into the global financial system.

Moreover, the rules regarding the amount of foreign currency that travelers may carry into or out of Ethiopia have been reconciled, providing clearer guidelines and reducing uncertainties for travelers. The central bank has also granted special foreign exchange privileges to companies operating in special economic zones, including the ability to retain 100 percent of their foreign exchange earnings. This move is aimed at attracting foreign investment and fostering economic development within these zones.

“The reform in the exchange rate system being introduced today is challenging in several respects, but at the same time, it is critically necessary,” the NBE emphasized. “The prevailing foreign exchange rate system, though initially meant to help ensure a stable exchange rate and low inflation, has instead resulted in the emergence of an unanchored parallel market exchange rate, together with high inflation.”

The context of these reforms is further underscored by Ethiopia’s recent economic history. On December 20, 2019, the IMF Board approved a three-year arrangement under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) for Ethiopia, worth about $2.9 billion. This arrangement was designed to help the country implement the Homegrown Economic Reform Plan, maintain macroeconomic stability, and improve living standards.

However, the programme was suspended due to the outbreak of conflict in the northern region of Tigray. The ensuing violence and instability caused significant disruptions to the economy and delayed the implementation of critical reforms. Negotiations with the IMF and World Bank resumed after a peace deal was reached in November 2022, paving the way for the resumption of financial support and the continuation of economic reforms.

2023, in the wake of a financial crisis triggered by the Covid-19 pandemic and the two-year war in Tigray, Ethiopia defaulted on a $33 million coupon payment on its Eurobond. This default placed Ethiopia alongside other African nations, such as Zambia and Ghana, which have also struggled to meet their external financial obligations. As of March 31, 2024, Ethiopia’s public debt stood at $65.82 billion, according to the country’s Finance Ministry. The total external debt increased by 0.5 percent to $28.38 billion from $28.24 billion as of June 30, 2023, reflecting the ongoing financial challenges facing the country.

The comprehensive reforms announced by the NBE represent a significant shift in Ethiopia’s economic policy. By embracing a market-based exchange rate system and liberalizing foreign exchange regulations, the government aims to tackle the root causes of its economic challenges. These changes are expected to enhance foreign currency inflows, stimulate economic activity, and pave the way for sustainable development. However, the successful implementation of these reforms will require careful management, strong institutional support, and ongoing collaboration with international financial institutions and the global community.

In conclusion, the National Bank of Ethiopia’s decision to allow market forces to determine the value of the birr and to liberalize foreign exchange regulations marks a watershed moment in the country’s economic history. These reforms are not just technical adjustments but are part of a broader strategy to transform Ethiopia’s economy, restore macroeconomic stability, and create a more inclusive and sustainable growth trajectory. As Ethiopia embarks on this challenging yet critically necessary path, the eyes of the world will be watching to see how these bold reforms unfold and impact the country’s future.